New Data on Amazon: Has the King Been Dethroned?

The 2022 eCommerce Executive Key Initiatives Report Reveals New Data on How Top Brands Really See Amazon in the Marketing Mix

It’s no secret that Amazon has been viewed as the King of eCommerce by shoppers and brands alike for years. The behemoth is in the unique position of being both a competitor and a channel for many brands, and simply by virtue of size, holds the keys to supply chains, order fulfillment, and distribution channels. Although even Amazon dealt with frustration in these areas during peak shopping times throughout the pandemic, the retail giant weathered the storm far better than most.

Data from 2021

Nearly half of the respondents from the 2021 eCommerce Investment and Innovation Trends Survey said that the pandemic made the competitive gap between retailers and Amazon even bigger. Although 33% of respondents viewed Amazon as a channel, 39% of them saw Amazon as both a competitor and a channel. This point of view was likely the reason why 42% of these same respondents were focused on solving shipping and inventory challenges in 2021. Brands also focused heavily on driving customers to their eCommerce sites last year; 53% of them invested between 5% and 20% of revenue into ad spend and over 22% said they were reinvesting more than 20% in this area in 2021. Additionally, e-retailers invested money into SEO, social media channels, and paid search in hopes of competing better against Amazon.

We asked our respondents if they thought that recent innovation and investments in eCommerce sites and digital experience have leveled the playing field for brands to compete with Amazon. The majority said yes.

2022 Survey Results

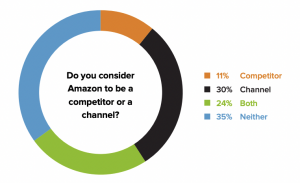

When we fast forward to 2022, the data paints a different picture. 35% of brands surveyed don’t view Amazon as either a competitor or a channel, and only 11% of brands view Amazon as a competitor.

It appears that the initiatives brands have taken in previous years to provide better online shopping experiences for their customers are working. Further, with omnichannel and personalized shopping becoming such a big part of e-commerce, shoppers are more likely to shop on their favorite brands’ sites where they feel a more personal connection. 59% of shoppers say that personalization has an impact on their decision to make a purchase, and 89% share that social media interactions also influence them.

The reality is that Amazon still owns a big part of eCommerce and that isn’t likely to change. However, as we emerge from the pandemic, online brands have also carved out plenty of room to grow. The data shows that if brands invest in site speed and the technologies shoppers demand, they will continue to meet their target growth rates. To read the 2022 eCommerce Executive Key Initiatives Report in full, click HERE.