It was another successful year for Yottaa customers, who saw Cyber 5 conversion rates of nearly 4%.

There was a lot of pressure on retailers to deliver high sales numbers during the Cyber 5 this year, to make up for a slowdown of consumer spending. Retailers were happy to see a record 200.4 million consumers shop, and Cyber 5 spending increase 7.8%.

Yottaa’s real-time visibility into ecommerce site performance revealed interesting consumer behaviors during this year’s Cyber 5 holiday shopping season. Here are the trends we uncovered:

1) Shoppers had less patience for slow-loading sites.

2) Shoppers weren’t casually browsing – they were on a mission.

3) Ecommerce sites using Yottaa saw increased conversion rates.

4) Shoppers increased browsing from mobile devices.

Let’s dive into YOTTAA’s data that led to these insights about 2023 Cyber 5 holiday shoppers.

1) Shoppers had less patience for slow-loading sites.

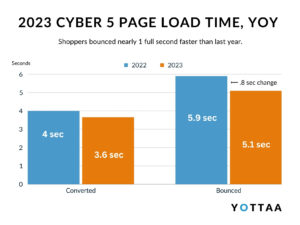

When looking at the average page load times experienced by shoppers who ultimately made a purchase compared to shoppers who bounced from the site, real shopper data shows that speed continues to be paramount.

During the 2023 Cyber 5, site visitors who ended up making a purchase experienced an average page load time of 3.66 seconds. Those who left without making a purchase had an average page load time of 5.17 seconds. When we compare those results to 2022, shopper patience seems to be dwindling by almost a full second. In 2022, the “bouncers” average load time was 5.9 seconds. Baseline expectations for site speed are increasing YoY.

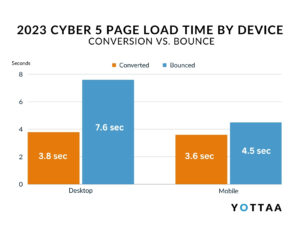

When we observe the data by mobile shoppers compared to desktop shoppers, things get even more interesting. Desktop shoppers who eventually bounced overall waited over 2 seconds longer than mobile shoppers.

Mobile shoppers expect faster experiences while desktop shoppers will accept slower experiences. But with more and more shoppers going mobile-first, ecommerce teams need to consider speed a top priority.

2) Shoppers weren’t casually browsing – they were on a mission.

Shoppers had very intentional purchase behavior this Cyber 5. Orders were up 17% with 2% fewer shoppers compared to last year. And the average session depth – how many webpages were visited during a shopping session – also decreased across the board by 13%. On average, fewer webpages of a website were visited during the online shopping experience.

Shoppers were on a mission to buy what they were after. Rather than browsing or exploring add-ons, they went to the product pages, put the products in their shopping cart and headed for a quick checkout.

Given the global economic downturn at the start of the year. 2023 has not been a year for flagrant buying behavior, and impulse purchases have been steadily declining over the past 3 years. And marketing strategies we are seeing emerge from many retailers we work with – embracing their existing customer base rather than spending on high digital advertising costs that are showing diminishing returns.

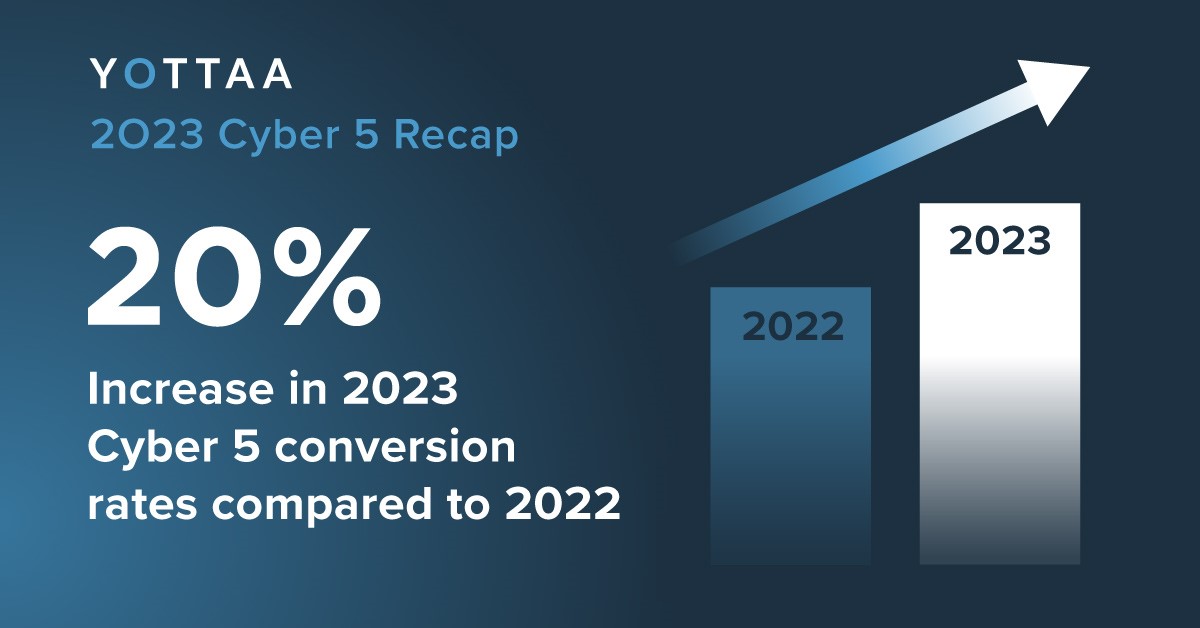

3) Site conversions for Yottaa customers increased YoY, and surpassed industry averages.

Our data showed conversion rates during the Cyber 5 increased significantly over last year. This year, the average conversion rate of YOTTAA customers during the Cyber 5 was 3.77%. This reflected nearly a 20% increase over 2022.

Comparing this to published baselines, YOTTAA customers converted at a higher rate:

Sources differ and every industry might have their own target baseline, based on consumer behavior. But most point to 2.5% or 3% as a target signaling strong conversion – so we’re thrilled to see our platform helping customers convert at rates nearing 4%.

4) Shoppers increased their browsing from mobile devices.

Adobe reported that mobile devices drove 51.8% of all eCommerce sales throughout Cyber Week, up from 49.9% in 2022. Yottaa has covered the rise of mCommerce in our latest ebook and blog posts, and our data from the Cyber 5 validates this trend even further.

Overall, 75% of all the sessions we observed came from mobile devices. Shoppers used their mobile devices 6% more during the Cyber 5, compared to the previous 5 days (75% vs. 69%). During the holidays, many shoppers aren’t as tied to their computers – maybe they’re visiting family, on the road, or perusing deals from their couch over pie.

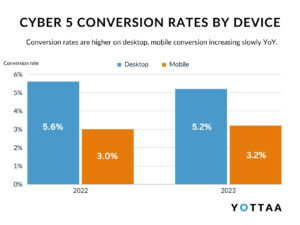

But were they buying? Our data tells an interesting story when we look at conversion rates.

The conversion rate of Cyber 5 mobile shoppers was 3.18%, and the conversion rate of Cyber 5 desktop shoppers conversion was 5.22%. We saw the same trend in the data last year during the Cyber 5 of 2022 – mobile shoppers conversion rate was lower (3.02% compared to 5.57%).

There are a few conclusions we can draw from this about shopping from mobile devices – one being that consumers enjoy browsing from their mobile phone, without having the same level of purchase intent as they do from a desktop. We also suspect that these sites may not have been optimized for the mobile buying experience. With mobile shoppers bouncing sooner if pages don’t load, lower conversions coming from mobile could signal a poor, slow mobile experience.

The Key Takeaways for eCommerce Teams

Putting all this data together, here are tips for eCommerce teams to round out a strong holiday season, and head into 2024 driving more sales from their sites:

1) Keep your page load times in check. As you add new third-parties or change site functionality, page speed is paramount and must be a critical metric your team monitors every day.

2) Maintain a high-quality mobile experience. holiday shoppers are browsing from their mobile devices. Try to close the gap between mobile conversion rates and desktop conversion rates.

3) Build an experience for ‘intentional’ shoppers. holiday shoppers this year are browsing less. Traffic is down, and visitors are browsing fewer pages. Make sure that your site is easy to navigate for a shopper who knows what they want.

—

Despite fears across the ecommerce landscape, consumer spending during the Cyber 5 largely surpassed expectations. Many of our customers leveraged tactics like deep discounts and flash sales to increase site traffic and sales during the Cyber 5.

And the holiday shopping season is far from over – YOTTAA team will continue to evaluate shopping behavior as the season progresses, for insights that will help your teams improve your site and achieve your sales goals.

To get a baseline understanding of your site speed, conversion rates and mobile experience, reach out to us for a free site snapshot.

Source: Yottaa platform data gathered from a sample set of over 275 ecommerce websites, November 2022 and November 2023.